In early January, I set out to compare SoundHound and Cerence AI, two companies at the forefront of conversational AI. Cerence’s recent collaboration with Nvidia sparked my curiosity, as the move was designed to enhance its large language model (LLM) capabilities. On the surface, the partnership seemed promising, but I wanted to go deeper.

The real question wasn’t just about developing audio AI technology—it was about building a durable business. Could Cerence–or any Audio AI company–maintain an edge in a rapidly evolving industry where technological advancements are constantly emerging?

From my findings, both Cerence and SoundHound had successfully integrated modern LLM technology into their solutions, offering fluid, real-time voice interactions. But when I examined their total addressable markets (TAM), business models, technology, management teams, financials, and valuation, I gave SoundHound a slight edge—with one major caveat: its market valuation was far too inflated to justify an investment.

However, one stat lingered on my mind. While researching Cerence, I came across a jaw-dropping claim on its website: “52% of worldwide auto production uses Cerence AI technology (TTM).”

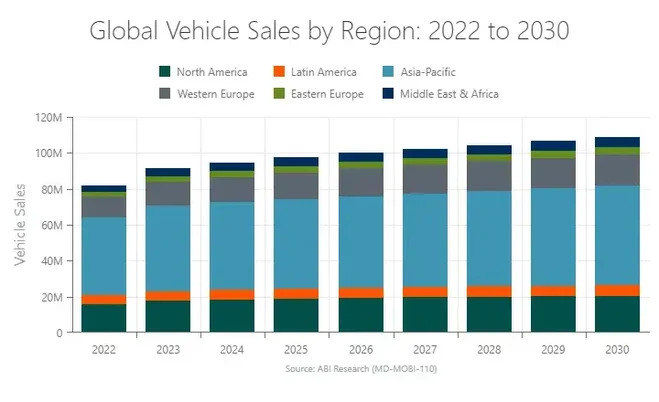

That is a staggering number given there were approximately 90 million vehicles produced globally in 2024 (Cerence supplied +46 million).

So why then has the company’s revenue stagnated and losses mounted in the past couple of years? If it has such a massive stranglehold on the automobile market, why is it not translating efficiently to its bottom line?

This uncharacteristic behavior of a near-monopolistic business was intriguing. Either Cerence was facing a temporary hiccup or it signalled deeper issues with the business or industry at large.

Here’s What I Found…

What is Cerence AI?

Cerence AI was born in 2019 as a spin-off from Nuance Communications, a pioneer in speech and language solutions for industries like healthcare, telecom, and finance. The goal? To sharpen its focus on the booming automotive AI market and seize the growing demand for in-vehicle conversational intelligence.

At the time of the spin-off, Cerence technology was already embedded in over 280 million vehicles, offering voice interactions in more than 70 languages. Fast forward to today, and that number has surged to over 500 million vehicles—a testament to Cerence’s industry dominance.

The company’s customer roster reads like a who’s who of the automotive world with more than 80 OEM and Tier-1 suppliers:

- Automakers (OEMs): BMW, XPeng, Stellantis, Ford, Daimler, Geely, Renault-Nissan, SAIC, Toyota, Harley-Davidson, and Volkswagen Group, among others. This segment accounts for 57% of revenue.

- Tier 1 suppliers: Companies like Aptiv, Bosch, Continental, DENSO TEN, NIO, and Harman, who supply key vehicle components. This accounts for 43% of revenue.

Cerence also boasts a global footprint, with revenue split across:

- 42% from the Americas

- 34% from Europe

- 24% from Asia

But market penetration alone isn’t enough. At the core of its business is Cerence’s proprietary technology, protected by more than 800 patents.

Its platform integrates advanced conversational AI, enabling seamless voice interactions through a combination of speech recognition, natural language processing, text-to-speech, and acoustic modeling. Unlike generic voice assistants, Cerence’s AI is specifically designed for the automotive environment, ensuring reliable, intuitive, and hands-free communication between drivers and their vehicles.

But its capabilities extend beyond voice. The company is pioneering multimodal interactions, incorporating gesture recognition, eye-tracking, predictive text, and handwriting recognition. This allows drivers to interact with their vehicles in more intuitive and dynamic ways, enhancing usability, accessibility, and safety.

A key advantage of Cerence’s system is its hybrid AI architecture, balancing edge computing with cloud-based intelligence. Its edge AI enables offline voice processing, ensuring low-latency responses without requiring an internet connection. This allows for near-instantaneous command execution and continuous functionality even in areas with weak or no connectivity. When online, Cerence taps into both its proprietary AI models and third-party large language models (LLMs) like GPT-4, providing drivers with an advanced, hybrid AI experience.

Now, through its partnership with Nvidia, Cerence is making a major push toward AI independence. The company is developing its own CaLLM (Cerence Automotive Large Language Model) family, which includes both CaLLM Cloud—a cloud-based LLM designed for complex in-vehicle interactions—and CaLLM Edge, a small, embedded AI model for on-device processing. This strategic move reduces Cerence’s reliance on external AI providers and positions it as a fully self-sufficient leader in automotive intelligence.

However, what truly sets Cerence apart is its white-label approach. Unlike consumer-facing AI assistants like Siri or Alexa, Cerence’s technology is fully customizable, allowing automakers and suppliers to tailor their voice AI to match their brand identity and specific vehicle needs. This flexibility has enabled Cerence to forge long-term relationships with some of the world’s largest automakers, reinforcing its role as an indispensable AI provider.

But it is not the only advantage the company has to offer.

Cerence AI’s Competitive Landscape

Cerence AI operates in a competitive space, but its primary challengers—SoundHound (SOUN) in the U.S. and iFlytek (002230.SZ) in China—lack the entrenched position it has in the automotive market.

While SoundHound’s conversational AI delivers a smooth and natural user experience, its financial scale is far smaller. Generating just $67.3 million in trailing twelve-month (TTM) revenue compared to Cerence’s $331.5 million in 2024, SoundHound’s true automotive market share remains unclear.

Meanwhile, iFlytek, with $305.2 million in TTM sales, focuses heavily on handheld consumer devices like smart recorders and translation tools, making it less of a direct competitor in-vehicle AI systems.

When it comes to core AI capabilities—audio processing and large language models (LLMs)—the differentiation between these competitors is becoming less apparent. Voice recognition and generative AI have matured to the point where quality enhancements yield diminishing returns. Additionally, as generative AI becomes more affordable and widely available, LLMs are increasingly commoditized, making it difficult for any player to claim a definitive technological advantage.

However, Cerence’s edge doesn’t lie solely in its AI’s performance—it lies in its deeply embedded position within the automotive industry.

Unlike SoundHound, which serves multiple industries, Cerence is laser-focused on transportation. This specialization allows it to develop AI solutions tailored to automakers’ precise needs, offering a level of integration and customization that competitors struggle to match.

Cerence’s real competitive moat is in its long-term relationships with major automakers and the stickiness of its embedded AI solutions. Developing and implementing a new in-car conversational AI model is a complex, resource-intensive process. Once a model is customized for a specific vehicle, the cost and effort required to switch providers are significant, making automakers far less likely to abandon Cerence for a competitor. This dynamic is why brands like BMW, Toyota, and Volkswagen continue to integrate Cerence’s AI across multiple vehicle generations. Having cultivated these partnerships for over two decades, Cerence enjoys a level of customer loyalty that is difficult to disrupt.

Another key advantage is Cerence’s global reach. Offering support for approximately 70 languages, the company is well-positioned to serve automakers across diverse markets, helping to diversify revenue streams while enabling expansion into regions where AI-powered automotive interfaces are still developing.

For a competitor to displace Cerence, it would take a groundbreaking leap in AI capabilities—one compelling enough to justify the high switching costs for automakers. As long as Cerence continues to evolve and incorporate cutting-edge technology, its existing customer base remains secure.

The bigger question is not whether Cerence can retain customers, but whether it can continue expanding its market share. Has it already reached its total addressable market, or is there room for growth? That remains to be seen.

Assessing Cerence AI’s Leadership and Insider Commitment

While Cerence AI has demonstrated technological strength and industry integration, one area that raises concerns is its leadership and insider ownership.

As a spin-off, it is understandable that executive ownership may be lower than in founder-led companies. However, Cerence insiders collectively hold just 1.54% of the company—approximately $8.74 million of its $568.3 million market capitalization (Simply Wall Street).

This includes modest stakes from key executives: Chairman Arun Sarin owns roughly 0.11% ($622.3 thousand), CTO & Chief Product Officer Nils Schanz holds 0.34% ($2.0 million), Chief Revenue Officer Christian Mentz owns 0.12% ($706.8 thousand), and Director Tom Beaudoin has 0.22% ($1.3 million). Notably, new CEO Brian Krzanich’s (former Intel CEO) ownership remains undisclosed.

In stark contrast, SoundHound AI’s insiders hold a significantly larger stake, owning 10.9% of the company, or approximately $565.4 million of its $5.5 billion market cap (Simply Wall Street). The company’s founders—Keyvan Mohajer, James Hom, and Seyed Emami—individually own 4.37% ($227.4 million), 0.68% ($35.6 million), and 4.67% ($243.2 million), respectively.

Beyond ownership, insider activity is another red flag. Neither company’s insiders have shown strong confidence through share purchases, with both seeing substantial insider selling. This lack of insider buying raises questions about management’s conviction in the long-term upside of their businesses.

From a leadership standpoint, Cerence’s management team remains largely untested. Many executives have been in their roles for less than a year following a significant restructuring effort. The company spent $17.1 million on restructuring costs, in 2024, to streamline operations, reduce expenses, and drive profitability—moves that included workforce reductions and a management overhaul. While these changes could position Cerence for stronger execution, leadership’s ability to drive long-term growth remains uncertain.

To their credit, the new team has taken steps to expand partnerships, securing agreements with Mapbox, Nvidia, and major customers such as JLR, Kawasaki, Renault, Tuya, and Skoda. However, the real test will be whether these partnerships translate into sustainable revenue growth and a competitive edge.

At this stage, it is too early to determine whether Cerence’s leadership has the strategic foresight and execution capability to deliver long-term value. Investors may need to wait several years before gaining confidence in the new management’s ability to steer the company toward sustained success.

Analyzing Cerence AI’s Financials

Cerence AI has certainly demonstrated the capacity to grow and maintain profitability in the past, but the journey has been far from smooth.

In FY 2021, the company posted impressive numbers, achieving a record $387.2 million in sales, net profits of $45.9 million, and generating $62.3 million in free cash flow. These results underscored Cerence’s potential and marked the company’s strong position within the conversational AI market.

However, the following years told a more challenging story. Revenue has steadily declined, and net profits have disappeared. In fact, Cerence’s net losses in 2022 ($310.8 million) and 2024 ($588.1 million) were largely driven by substantial goodwill impairment charges of $213.7 million and $609.2 million, respectively.

These impairment charges reflect the risks of overvaluing intangible assets, especially in the face of unfavorable macroeconomic conditions and stock price declines. While these impairments are non-recurring, they underscore the risks associated with the company’s financial structure and the broader volatility in the market.

Despite these setbacks, Cerence is showing signs of recovery. In 2024, the company saw a rebound, posting $331.5 million in sales—the second highest in its history—while improving its gross margin to 73.7% and operating margin to 21.8%. Furthermore, Cerence generated $12.2 million in free cash flow, demonstrating solid financial discipline. With $121.0 million in cash on hand and a manageable $293.2 million in debt, Cerence is in a relatively stable position from a liquidity perspective.

The company’s future will depend heavily on its new management team and their ability to capitalize on the improvements made in their first year. If the team can continue to build on this momentum and execute effectively, Cerence may very well secure its place as a dominant player in the conversational intelligence industry. However, it is still too early to predict with certainty whether the company can regain its footing and sustain long-term growth.

Cerence AI’s Valuation and Investment Outlook

When it comes to valuation, Cerence AI is currently trading at what appears to be a reasonable price, yet the company’s future remains clouded by uncertainties surrounding its management team and fundamentals. As a result, justifying an investment in Cerence at this moment is a challenging proposition.

At present, Cerence boasts a market cap of $568.3 million, with a price-to-sales (P/S) ratio of 1.69, a price-to-book (P/B) ratio of 4.09, and a free cash flow yield of 2.15%.

While there is potential for improvement in the company’s valuation through new partnerships and cost restructuring, the question of whether Cerence possesses a durable competitive advantage remains unanswered. Without clear evidence of such an advantage, it’s difficult to commit to a position in the stock.

Moreover, investors must consider the opportunity cost of investing in Cerence. Given the range of alternative assets available, many offering more compelling fundamentals and valuations, there are arguably more attractive opportunities to pursue at present.

Looking at Cerence’s history as a publicly traded company, it becomes apparent that it has been a casualty of the 2021 crypto and AI market bubble. The stock once peaked at $133.43 per share in February 2021, but now trades at just $13.22—a staggering 90.1% decline.

While the current valuation is more realistic and grounded in the company’s present-day realities, I believe there is a limited margin for safety at this price point. Given the lack of consistent profitability and long-term growth visibility, I’m choosing to take a pass on Cerence for now. I would prefer to wait for clear signs that the company has cemented itself as a profitable and stable business in a growing market before considering an investment.

The Numbers Don’t Lie: Why Cerence AI Has Struggled to Capitalize on Its Market Leadership

Going into this analysis, I wanted to understand one fundamental question: why has Cerence, despite commanding a 52% market share, failed to translate its dominance into sustained financial success? The answer isn’t a single misstep but rather a culmination of structural challenges, strategic miscalculations, and the changing dynamics of the conversational AI industry.

One of the most glaring issues has been Cerence’s handling of goodwill. At the height of the AI boom in 2020 and 2021, the company valued its goodwill at $1.13 billion, making up 66.9% and 66.2% of its total assets, respectively. But as market enthusiasm cooled and economic realities set in, it became clear that these valuations were far too optimistic.

The result? Massive goodwill impairment charges that wreaked havoc on Cerence’s financials. In 2022 and 2024, the company reported net losses of $310.8 million and $584.6 million, largely due to these write-downs. However, if we strip out these impairment charges, the picture changes dramatically—a $97.1 million net loss in 2022 and a net profit of $21.1 million in 2024. Still not perfect, but a far more stable trajectory than the raw numbers suggest.

Beyond accounting adjustments, the bigger challenge Cerence faces is structural: the economics of conversational AI are inherently deflationary. LLMs, cellular data, and AI-driven audio software are all becoming cheaper, which means the very technology Cerence sells is rapidly commoditizing.

As generative AI becomes more accessible and cost-effective, Cerence is under constant pressure to compete on volume rather than pricing power. Unlike some enterprise software businesses that benefit from recurring revenue and efficient economies of scale, conversational AI in vehicles doesn’t enjoy the same pricing leverage.

Customers now have options—SoundHound AI is a rising competitor, and automakers may increasingly develop in-house solutions as technology advances. The only way for Cerence to maintain its dominance is to offer a product that is unquestionably superior to its competitors.

The silver lining? Cerence’s current valuation is more grounded in reality, and with its goodwill write-offs behind it, the company can finally shift focus to actual business growth. But this doesn’t mean the road ahead is easy.

Cerence is in a race against time. If it aspires to be the premium player in conversational AI, it must out-innovate SoundHound AI and other emerging competitors. Simply matching their capabilities won’t be enough—it must surpass them.

If Cerence can’t create undeniable technological differentiation, its services will continue to face pricing pressure, potentially leading to stagnation or even obsolescence. The next few years will determine whether Cerence can leverage its scale and industry relationships to solidify its position—or if it becomes another AI company that failed to capitalize on its early lead.

Final Thoughts

Cerence AI is a good business, but not yet a great one. It has carved out a dominant position in the automotive conversational AI market, yet it has struggled to translate that leadership into long-term financial stability.

For a company with a 52% market share, one would expect a far stronger financial trajectory. Instead, Cerence finds itself at a pivotal moment, where execution over the next few years will determine whether it cements its position as an indispensable industry leader—or fades into irrelevance.

With a new management team at the helm, there is an opportunity for reinvention. But reinvention takes time, and time is not on Cerence’s side. The rapid commoditization of generative AI, LLMs, and conversational interfaces means that maintaining pricing power and differentiation will be an uphill battle. Cerence must move beyond incremental improvements and instead set the pace for the industry—because if it doesn’t, competitors like SoundHound AI will.

At this stage, the uncertainty outweighs the opportunity. Until Cerence proves it can consistently innovate, sustain profitability, and build a durable competitive moat, I’m staying on the sidelines.

That said, I’d love to be proven wrong.

Disclosure/Disclaimer

We are not brokers, investment, or financial advisers, and you should not rely on the information herein as investment advice. If you are seeking personalized investment advice, please contact a qualified and registered broker, investment adviser, or financial adviser. You should not make any investment decisions based on our communications. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT recommendations. The securities issued by the companies we profile should be considered high risk and, if you do invest, you may lose your entire investment. Please do your research before investing, including reading the companies’ public filings, press releases, and risk disclosures. Information contained in this profile was provided by the company, and extracted from public filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it. The commentary and opinions in this article are our own, so please do your research.

Copyright © 2025 Micro Math Capital, All rights reserved.